2 min read

The 4th of September 2022

11:40

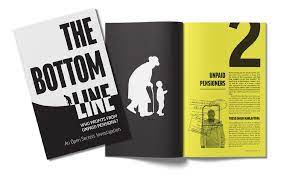

Open Secrets, together with the Unpaid Benefits Campaign, began an investigation into the potentially unlawful and criminal conduct of fund administrators, asset managers and other financial actors regarding unclaimed pension funds. On the 23rd of October 2019, Open Secrets published the report, The Bottom Line: Who Profits from Unpaid Pensions? and an accompanying booklet, Look Beyond the Bottom Line, that focused on the role played by big corporations who administer pension funds and found that this resulted in over R50 billion in pensions owed to employees and the beneficiaries.

Open Secrets, together with the Unpaid Benefits Campaign, began an investigation into the potentially unlawful and criminal conduct of fund administrators, asset managers and other financial actors regarding unclaimed pension funds. On the 23rd of October 2019, Open Secrets published the report, The Bottom Line: Who Profits from Unpaid Pensions? and an accompanying booklet, Look Beyond the Bottom Line, that focused on the role played by big corporations who administer pension funds and found that this resulted in over R50 billion in pensions owed to employees and the beneficiaries.

Open Secrets’ Head of Investigations, Michael Marchant, joined Radio Islam International to discuss this unfortunate situation.

According to Marchant, more than four million South Africans and migrant pensioners have not received their pension funds, even after several attempts to claim them. A “people’s hearing” hosted by Open Secrets and the Unpaid Benefits Campaign in Johannesburg allowed pensioners to testify about their experiences.

The report also detailed the unlawful cancellation of pension funds between 2007–2013 by the Financial Services Board (FSB). This entailed the mass-cancellation of 6757 orphan pension and provident funds (funds without a board of trustees), many of which contained assets owed to beneficiaries.

Marchant explained that the entire situation of exploitation began during the Apartheid era as many businesses collected the monies from employees contributing toward a pension fund. Still, little or few correct details were provided to the funds to allow them to reimburse those who claimed.

The efforts by these organisations have seen an acceleration in the last few years, including a search engine on the FSCA website that allows employees and beneficiaries to trace a possible benefit outstanding.

However, Marchant says this will be an ongoing issue as beneficiaries are traced. Therefore, the government’s assistance in getting the Standing Committee on Finance to hold hearings immediately is crucial.

The new legal framework for South Africa’s financial sector now provides greater powers to investigate the behaviours of financial corporations, which should compel the FSCA to use these powers urgently to thoroughly investigate and review all cancelled funds and outstanding funds to ensure they reach those to whom they belong.

[LISTEN] to the podcast here

By Annisa Essack

kzn@radioislam.org.za

0 Comments